25+ net pay calculator maine

Pay Your Team And Access HR And Benefits With The 1 Online Payroll Provider. Web The Maine Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2023.

Maine Paycheck Calculator Smartasset

Fill out our contact form or call 877 729-2661 to speak with Netchex.

. If this employees pay frequency is weekly the calculation is. Web Maine State Payroll Taxes for 2023. Web Do you want to get more for your business with Payroll Benefits HR made easy.

Now that were done with federal taxes lets look at Maines state income taxes. Web Maine paycheck calculator. In Maine the duties employees are responsible for is.

The state minimum salary threshold for Maine is 73559 per week which is equivalent to 38250 annually. Just enter the wages tax withholdings and other information. Ready for a live demo.

Web For salaried employees the number of payrolls in a year is used to determine the gross paycheck amount. It is equal to 25 of regular expenses and 50 of quality. Web Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Maine.

That means that your net pay will be 43041 per year or 3587 per month. If you make 70000 a year living in Maine you will be taxed 11500. Web Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Mortgage rates in Maine. That means that your net pay will be 43113 per year or 3593 per month. Web However new employers are given relief as they only have to pay a flat rate of 183.

Average Annual Salary in Maine is 60530. Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. If you make 55000 a year living in the region of Maine USA you will be taxed 11888.

Web If you make 55000 a year living in the region of New York USA you will be taxed 11959. Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. The Livable wage in Maine for a single adult.

Web Maine Income Tax Calculator 2022-2023. Web How to calculate annual income. Pay Your Team And Access HR And Benefits With The 1 Online Payroll Provider.

Your average tax rate is 1167 and your marginal tax rate is 22. Web Use ADPs Maine Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Maine charges a progressive income tax.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. For example if an.

Politics Archives Generation180

774 State Route 12 Waterville Ny 13480 Zillow

Calculate Take Home Pay

Rytyuh0yaikhzm

Maine Real Estate Listings F O Bailey Real Estate F O Bailey Real Estate

Paycheck Calculator Take Home Pay Calculator

New Tax Law Take Home Pay Calculator For 75 000 Salary

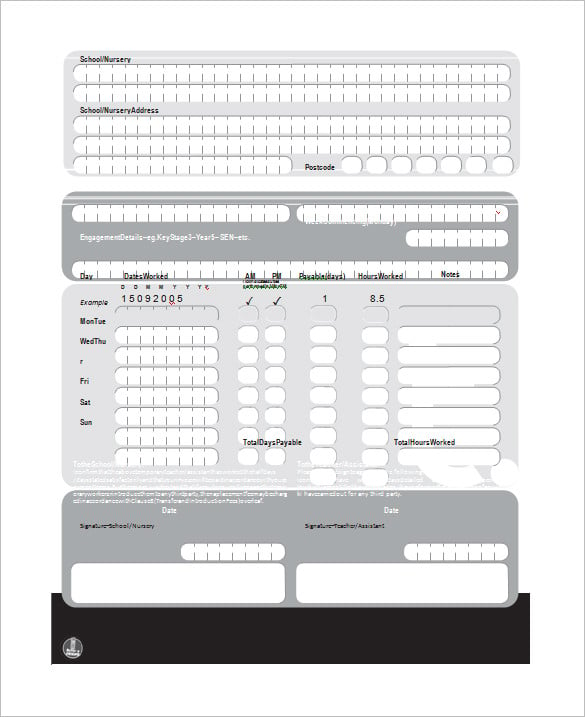

Free 6 Sample Net Pay Calculator Templates In Pdf Excel

Dem Rep Truckers Don T Have A Lot Of Brains In Their Heads The Maine Wire

8 Salary Paycheck Calculator Doc Excel Pdf

Gross Pay And Net Pay What S The Difference Paycheckcity

Take Home Pay Calculator

Rytyuh0yaikhzm

325 Belfast Road Camden Me Real Estate Property Mls 1547672

How Are Dividends Taxed 2023 Dividend Tax Rates The Motley Fool

Maine Paycheck Calculator Tax Year 2022

Employer Resources For 401 K Betterment For Business